Ira calculator 2020

This limit is 305000 in 2022 290000 in 2021 285000 in 2020 and 280000 in 2019 and is adjusted annually. You can contribute to a Roth IRA if your Adjusted Gross Income is.

What Is The Best Roth Ira Calculator District Capital Management

Your retirement is on the horizon but how far away.

. Get started by using our. Whether you are looking for a retirement score or a retirement income calculator Fidelitys retirement tools calculators can help you plan for your retirement. Calculate your earnings and more.

Reviews Trusted by Over 45000000. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Less than 140000 single filer Less than 208000 joint filer Less than.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

Ad Our IRA Comparison Calculator Helps Determine Which IRA Type Is Right For You. Account balance as of December 31 2021. How is my RMD calculated.

The contribution limit is also impacted by your filing status and whether. Your life expectancy factor is taken from the IRS. The Roth IRA calculator defaults to a 6 rate of return which can be adjusted to reflect the expected annual return of your investments.

Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Contributions are made with after-tax dollars. While long term savings in a Roth IRA may produce.

Ready To Turn Your Savings Into Income. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. The calculator will estimate the value of the Roth.

Plan contributions for a self-employed individual are deducted. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. It is important to.

Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. Required Minimum Distribution Calculator. There are many IRA account types to consider as you plan for retirement and each works differently depending on your life circumstances and financial goals.

Compare 2022s Best Gold IRAs from Top Companies. In 2020 the standard contribution limit is 6000 for individuals and if youre age 50 or older it increases to 7000. This calculator assumes that you make your contribution at the beginning of each year.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

The distributions are required. This calculator has been updated to reflect the new. Calculate your earnings and more.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. If you want to simply take your. Automated Investing With Tax-Smart Withdrawals.

You are retired and your 70th birthday was July 1 2019.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Ira Calculator Forbes Advisor

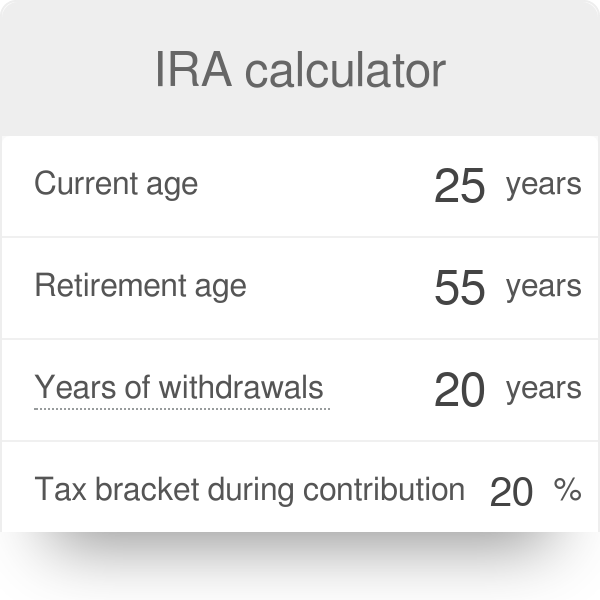

Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Retirement Withdrawal Calculator For Excel

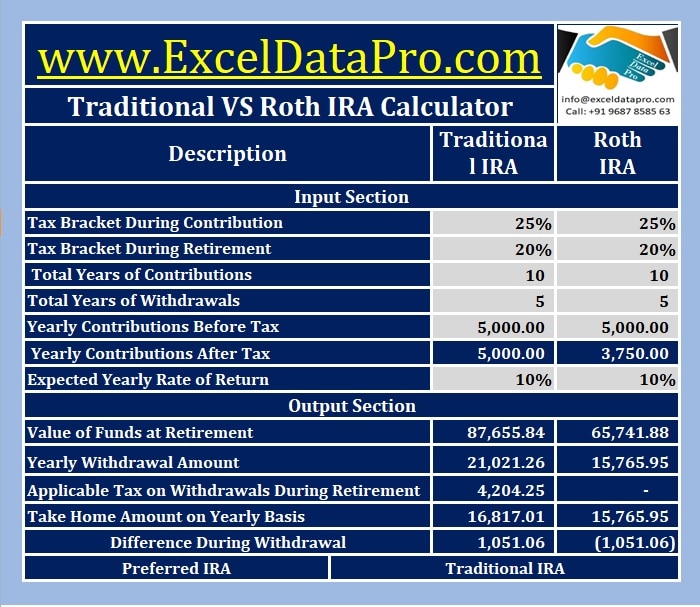

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

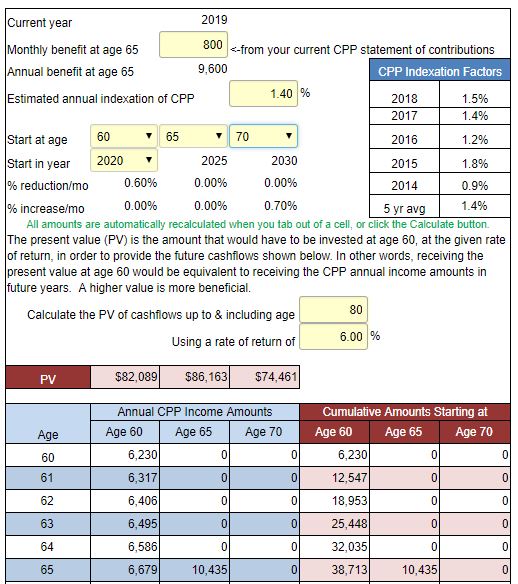

Taxtips Ca Cpp Retirement Pension Calculator

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Roth Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management